Ottawa, May 07, 2024 (GLOBE NEWSWIRE) -- The global automotive connector market size was valued at USD 7.86 billion in 2023 and is predicted to hit around USD 11.76 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1035

The automotive industry is undergoing a transformation driven by rapid advancements in connectivity and communication technologies. From vehicle-to-everything (V2X) communications to in-vehicle connectivity and the smartization of transportation, these innovations are reshaping the way vehicles interact with their surroundings and with each other.

One of the key enablers of these technologies is the use of high-performance connectors, which play a crucial role in facilitating seamless data transfer and communication between various devices within vehicles and across the transportation ecosystem. These connectors ensure reliable and efficient connectivity, enabling vehicles to exchange critical information in real-time and support a wide range of applications, from advanced driver assistance systems (ADAS) to autonomous driving capabilities.

The increasing interest in connectivity and communication is driving the rapid growth of the connected automobile industry, as automakers and technology companies collaborate to develop and deploy innovative solutions that enhance vehicle connectivity and intelligence. By leveraging the latest wireless communication technologies, such as 5G and dedicated short-range communication (DSRC), vehicles can communicate with each other, with infrastructure, and with other connected devices, enabling new capabilities and services that improve safety, efficiency, and convenience for drivers and passengers.

One example of this collaboration is the development of programs aimed at leveraging vehicle wireless communications to improve various aspects of vehicle performance and safety. These programs focus on enhancing response times, enabling pedestrian detection systems, and optimizing overall vehicle performance through advanced communication protocols and algorithms. By harnessing the power of connectivity, vehicles can become more responsive, adaptive, and intelligent, paving the way for the next generation of connected and autonomous vehicles.

The automotive industry's embrace of connectivity and communication technologies represents a paradigm shift towards a more connected, intelligent, and efficient transportation ecosystem. Through collaboration and innovation, stakeholders across the industry are working together to unlock the full potential of these technologies, driving advancements in safety, efficiency, and mobility for the vehicles of tomorrow.

The participation of CEA-Leti researchers in the EU Horizon 2020 project provides valuable insights into the advancement of vehicle-to-everything (V2X) communications technology. By leveraging the agency's expertise and examples, the project aims to evaluate and demonstrate the connectivity and collaboration capabilities of vehicles, with a specific emphasis on enhancing accessibility and safety for all road users, including pedestrians, workers, and cyclists. This initiative is poised to have a profound impact on the connected car market in the years to come, driving innovation and shaping the future of automotive technology.

However, the automotive industry is not without its challenges, particularly concerning the global supply chain. Disruptions such as shortages of raw materials, space constraints, or logistical competition can significantly impact automobile production and business operations. These disruptions pose a risk to companies as they may struggle to procure the necessary materials for manufacturing components, leading to delays and shortages of goods.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

To mitigate these risks, automotive companies must adopt proactive measures to manage their supply chains effectively. This may involve diversifying sourcing strategies, establishing contingency plans, and fostering closer collaboration with suppliers to ensure resilience and flexibility in the face of unforeseen challenges. Additionally, leveraging digital technologies and data analytics can enhance supply chain visibility and enable real-time monitoring of inventory levels, helping companies anticipate and respond to potential disruptions more effectively.

V2X communications technology hold promise for the future of the automotive industry, it is essential for companies to remain vigilant and proactive in addressing supply chain challenges. By adopting a strategic and proactive approach to supply chain management, automotive companies can navigate disruptions more effectively and maintain their competitiveness in an increasingly dynamic and interconnected global marketplace.

As the automotive industry undergoes a transition towards electric vehicles (EVs) and hybrid vehicles, driven by the integration of battery packs, electric motors, and charging systems, there is a corresponding increase in demand for products that consume substantial amounts of electricity. Moreover, the evolution towards autonomous vehicles, reliant on sophisticated sensor arrays and control systems, necessitates robust connections capable of transmitting data rapidly and reliably, thereby fueling the expansion of high-speed data transmission technologies.

In response to these trends, automotive connector manufacturers are continually innovating to enhance productivity, reduce costs, and ensure a stable supply chain to meet the evolving needs of the automotive industry. This includes advancements in materials, manufacturing processes, and design methodologies aimed at improving performance, reliability, and efficiency across a broad spectrum of applications.

Furthermore, concerns regarding liability and safety recovery have prompted the automotive industry to prioritize rigorous testing, quality control, and design enhancements to mitigate risks associated with connectivity issues. This focus on safety is particularly evident in the automotive connector market, where connectors play a critical role in safety and security applications.

For instance, connectors are integral components in essential safety systems such as airbags, car immobilizers, and anti-lock braking systems (ABS), where reliability and durability are paramount. Additionally, the rise in vehicle theft has driven demand for connected vehicle security systems, further underscoring the importance of robust and secure connectors in safeguarding both vehicles and occupants.

The automotive connector industry is poised to maintain its leadership position in safety and security applications, with an anticipated increase in market share in the coming years. By continuously innovating and adapting to evolving industry trends and requirements, automotive connector manufacturers are well-positioned to play a pivotal role in shaping the future of automotive technology and safety.

Automotive Connector Market Analysis

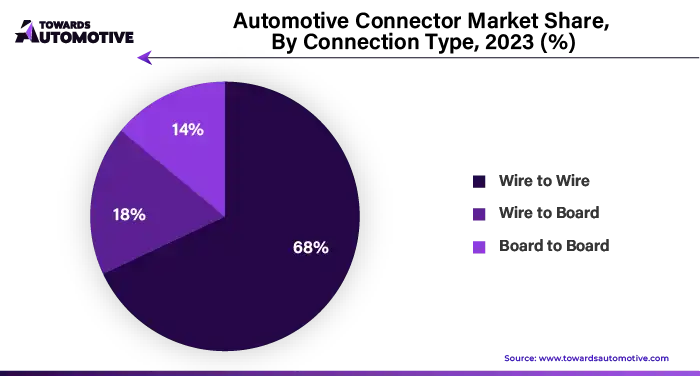

The cable-to-wire segment is expected to hold a significant market share, accounting for 50% by 2022, reflecting the growing importance of this connection type in modern vehicles with advanced electronic systems. Cable-to-wire connectors play a crucial role in facilitating uninterrupted communication and efficient energy distribution within vehicles, particularly as automotive technology becomes increasingly complex.

In electric vehicles (EVs) and hybrid vehicles, where energy management is paramount, cable-to-wire connectors are instrumental in ensuring the seamless transmission of power between different components such as battery packs, electric motors, and charging systems. These connectors provide a reliable and efficient means of connecting cables to wires, enabling the efficient transfer of energy while minimizing signal loss and electrical interference.

Moreover, as technologies like advanced driver assistance systems (ADAS), infotainment systems, and electric powertrains continue to advance, the demand for robust wire-to-wire connectors is on the rise in the automotive industry. These connectors facilitate the connection of wires within the vehicle's electrical system, providing a secure and dependable interface for transmitting data and power between various electronic components.

Metal-to-metal connectors, in particular, are favored for their durability, reliability, and ability to withstand harsh operating conditions, making them ideal for automotive applications where reliability is paramount. Whether it's ensuring the seamless integration of advanced safety features or optimizing the performance of cutting-edge infotainment systems, wire-to-wire connectors play a critical role in enabling the functionality and efficiency of modern vehicles.

The cable-to-wire segment is poised to maintain its dominance in the automotive connector market, driven by the increasing complexity of vehicle electronics and the growing demand for reliable and efficient connectivity solutions. As automotive technology continues to evolve, wire-to-wire connectors will remain indispensable components, supporting the advancement of next-generation vehicles and enhancing the driving experience for consumers worldwide.

The commercial vehicle market is poised to capture over 55% of the connected vehicle market by 2022, reflecting the rapid advancements in technology within this sector. As the automotive industry embraces features such as telematics, GPS systems, advanced safety systems, and efficient power management, there is a corresponding surge in demand for connected devices that facilitate seamless communication and power distribution.

Commercial vehicles, including trucks, buses, and vans, are increasingly incorporating advanced technologies to enhance safety, efficiency, and productivity. Telematics systems, for example, enable fleet managers to remotely monitor vehicle performance, track assets, and optimize routing, leading to improved operational efficiency and cost savings. GPS systems provide real-time location data, allowing for precise navigation and route optimization, while advanced safety systems such as collision avoidance and lane departure warning systems enhance driver safety and mitigate risks on the road.

Furthermore, as the automotive industry shifts towards electrification, with the growing adoption of electric vehicles (EVs) and hybrid vehicles, the importance of components for managing electronic connections becomes even more pronounced. Connected devices play a pivotal role in facilitating the integration of complex electrical systems within these vehicles, ensuring reliable communication and power distribution between various components such as battery packs, electric motors, and charging systems.

Reliability and performance are paramount in commercial vehicles, where downtime can result in significant losses for businesses. Connected devices that offer robust connectivity and efficient power management help improve vehicle performance and security, enabling fleet operators to maintain operational continuity and maximize productivity.

Commercial vehicle market is driving the demand for connected devices in the automotive industry, fueled by advancements in technology and the adoption of features aimed at enhancing safety, efficiency, and sustainability. As the industry continues to evolve, connected devices will play an increasingly integral role in supporting the development and deployment of next-generation commercial vehicles, keeping pace with ever-changing technology and meeting the evolving needs of fleet operators worldwide.

Reliability and Durability Standards

Indeed, reliability and long-term usability are paramount considerations for companies operating in the automotive market. Modern vehicles are equipped with powerful electronics that govern critical systems such as airbags and GPS navigation. Connectivity solutions employed in these systems must exhibit both reliability and durability, as malfunctions can have severe consequences.

Link solutions encompass a broad spectrum of connectivity options, ranging from low-frequency connections to high-resolution interfaces. Regardless of the specific application, the electrical equipment utilized in critical automotive systems must meet stringent reliability standards to ensure optimal performance and safety over the vehicle's lifespan.

In the event of a malfunction or failure in critical systems, such as airbag deployment or GPS navigation, the repercussions can be dire, posing risks to both occupants and other road users. As such, automotive manufacturers and suppliers prioritize the selection of reliable and durable components and connectivity solutions to mitigate the likelihood of system failures and uphold vehicle safety standards.

Moreover, as vehicles become increasingly reliant on electronic systems for functions beyond basic transportation, such as driver assistance features and infotainment systems, the demand for robust and dependable electrical equipment continues to escalate. Companies in the automotive market must invest in rigorous testing and quality control processes to ensure that their products meet or exceed industry standards for reliability and durability.

The Number Of Heavy-Duty Trucks Is Rising

The automotive industry is undergoing a transformative shift driven by the growing demand for better and more efficient transportation solutions. Automakers are increasingly focusing on creating and selling cutting-edge vehicles that excel in all weather conditions, leading to advancements in vehicle design and performance. This, in turn, is fueling the growth of the global connected car market as vehicles become more technologically advanced and interconnected.

Advances in business technology are playing a crucial role in driving the need for specialized connectors to support vehicle enhancements such as electrification, autonomous driving, and greater connectivity. These connectors enable seamless communication and power distribution within vehicles, facilitating the integration of advanced electronic systems and improving overall vehicle performance and functionality.

Furthermore, regulations governing vehicle safety, emissions, and performance often dictate specific components and standards, influencing vehicle design and adoption. Automakers must adhere to these regulations and standards to ensure compliance and meet customer expectations for safety, efficiency, and performance.

The need for safe and reliable electrical connections for critical automotive components such as airbags, engine management systems, and parking sensors is paramount in vehicle design and operation. Failure of these components due to poor connectivity can have serious consequences, highlighting the importance of high-quality connectors in automotive applications.

Moreover, the rise of electric and hybrid vehicles has necessitated the development of specialized connectors for high-voltage systems and batteries. These connectors play a crucial role in facilitating the efficient transfer of power within electric vehicles, supporting the automotive industry's efforts to reduce emissions and increase fuel efficiency.

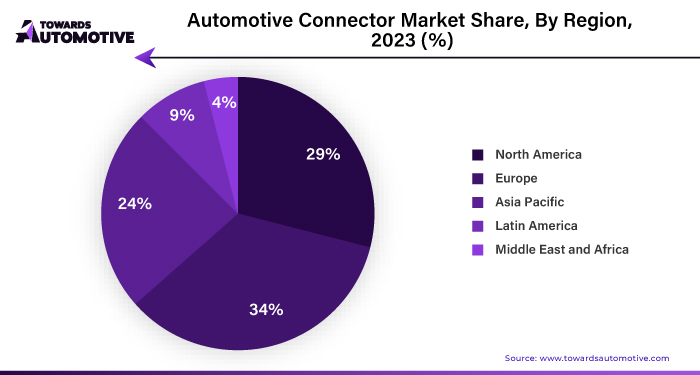

Europe is Expected to Capture a Larger Market Share

Europe leads the way in advancing vehicle safety standards, with America and the Asia-Pacific region closely following suit. The increasing demand for electric vehicles (EVs) in Europe, coupled with government initiatives to support the automotive industry's development, is poised to positively influence the future growth of connected cars in the region. This aligns with the evolving needs of customers, driving the demand for advanced connectivity solutions in vehicles.

Connector manufacturers must swiftly adapt to these trends by enhancing performance to meet the growing requirements for vehicle safety and security. For instance, TE Connectivity (TE) specializes in producing data connectors, particularly high-speed and well-spaced connectors, to support the connectivity needs of modern vehicles. By offering reliable and efficient connectivity solutions, TE contributes to improving vehicle safety and enhancing the overall driving experience for consumers.

Similarly, Harting Technology Group expanded its IX Industrial® Micro Data Link product line in January 2021, introducing a new radio broadcast solution designed for infotainment systems in passenger trains and buses. This solution provides a smaller and lighter alternative to traditional lines used in railways, catering to the demand for compact and efficient connectivity solutions in the transportation sector.

Overall, the automotive industry's shift towards connected vehicles is driving the need for advanced connectivity solutions that enhance safety, efficiency, and convenience for consumers. By leveraging innovative technologies and addressing evolving market demands, connector manufacturers play a crucial role in shaping the future of connected cars and supporting the ongoing development of the automotive industry worldwide.

Automotive Connector Market Key Players

- TE Connectivity Ltd

- Yazaki Corporation

- J.S.T. Mfg Co. Ltd

- Molex Incorporated (Koch Industries Inc.)

- Amphenol Corporation

- Luxshare Precision Industry Co. Ltd

- Aptiv PLC

- Hirose Electric Co. Ltd

- Samtec

- Lumberg Holding

- Sumitomo Wiring Systems Ltd

Automotive Connector Market Recent Developments

- In January 2023, Bosch Automotive, a leading provider of automotive technology solutions, announced a strategic partnership with Amphenol Corporation to develop advanced connectivity solutions for electric and autonomous vehicles. The collaboration aims to leverage Bosch's expertise in automotive technology and Amphenol's innovative connector solutions to address the evolving connectivity needs of next-generation vehicles.

- In September 2022, Sumitomo Electric Industries, Ltd., a global leader in automotive components and electrical systems, introduced the S-LVDS (Scalable Low-Voltage Differential Signaling) automotive connector series. The S-LVDS connectors are designed to meet the increasing demand for high-speed data transmission in modern vehicles, supporting advanced driver assistance systems (ADAS), infotainment systems, and autonomous driving technologies.

- In March 2022, the announcement of a joint venture between Rosenberger Hochfrequenztechnik GmbH & Co. KG, a leading provider of high-frequency connectivity solutions, and a prominent automotive manufacturer. The partnership aims to develop innovative RF (Radio Frequency) connectors and antennas for next-generation vehicles, supporting emerging technologies such as 5G connectivity, vehicle-to-everything (V2X) communication, and advanced radar systems.

- In November 2022, ITT Inc., a global diversified manufacturing company, unveiled its latest automotive connector solution, the Triton Series. The Triton Series connectors feature enhanced sealing and vibration resistance capabilities, making them ideal for harsh automotive environments. These connectors are designed to meet the stringent requirements of electric and hybrid vehicles, ensuring reliable performance and durability in demanding applications.

- Continental AG, a leading automotive technology company, announced in April 2022 the launch of its new generation of high-voltage connectors for electric vehicles. The connectors feature innovative design enhancements to improve electrical conductivity, heat dissipation, and durability, supporting the efficient transfer of power within electric drivetrains and battery systems.

- In January 2023, Hirose Electric Co., Ltd., a global leader in connector technology, unveiled its latest automotive connector series, the HR41 Series. These connectors are specifically designed to meet the high-speed data transmission requirements of advanced driver assistance systems (ADAS) and autonomous driving applications. The HR41 Series connectors feature compact designs and robust construction, ensuring reliable performance in automotive environments.

Browse More Insights of Towards Automotive:

- The vehicle security systems market size to uprise from USD 11.40 billion in 2023 and is expected to calculate USD 18.74 billion by 2032, growing at CAGR of 4.86% from 2023 to 2032.

- The automotive interior material market size is anticipated to witness substantial growth, projecting an increase from USD 58.26 Billion in 2023 to USD 84.27 Billion by 2032. The CAGR for the forecast period (2023-2032) is estimated at 4.19%.

- The automotive pneumatic actuator market size was valued at USD 20.04 billion in 2022, is developing strongly. With a predicted value of USD 32.30 billion at the end of the projection period in 2032, it has a CAGR of more than 5.44% from 2023 to 2032.

- The automotive smart key market size is expected to increase from USD 18.25 billion in 2023 to an estimated USD 27.67 billion by 2032, with a compound yearly growth rate (CAGR) of 5.42% over the forecast period (2023-2032).

- The global e-bike motors market size to rise from USD 4.98 billion in 2022 to calculate USD 16.14 billion by 2032, expanding at CAGR of 13.96% between 2023 and 2032.

- The automotive night vision system market size to surge from USD 2.98 billion in 2022 and predicted to hit USD 11.41 billion by 2032, expanding at CAGR of 12.3% from 2023 to 2032.

- The mild hybrid vehicles market size was valued at USD 112.76 billion in 2022 and is projected to reach USD 376.24 billion by 2032, with a CAGR of 11.69% during the forecast period.

- The Adaptive Cruise Control (ACC) and Blind Spot Monitoring (BSD) market size reached a value of USD 5.30 billion in 2022 and is projected to grow at a CAGR of 7.73% during the period of 2022 to 2032, reaching USD 11.58 billion by 2032.

- The automotive spark plugs and glow plugs market size was valued at USD 8.89 billion in the year 2022. It is anticipated to grow to USD 12.35 billion by the year 2032, registering a CAGR of 3.28% in terms of revenue during the forecast period.

- The electric vehicle battery market size is estimated at USD 43.68 billion in 2022, and is expected to reach USD 252.02 billion by 2033, growing at a CAGR of 21.50% during the forecast period (2022-2032).

Automotive Connector Market Segmentation

By Connection type

- Wire to Wire

- Wire to Board

- Board to Board

By System type

- Sealed Connection

- Unsealed Connection

By Application

- Body control

- Safety and security system

- Engine control and cooling system

- Fuel and Emission Control

- Infotainment

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Propulsion

- ICE

- Electric

- Hybrid

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Rest of Middle East and Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1035

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive